Typical Montana Home Value Up 66 Percent In Four Years

Montana’s typical home value has increased by twothirds in four years, according to new valuations published this month by the Montana Department of Revenue.

The department estimates that the median residential property in Montana was worth $378,000 as of the beginning of last year. Four years previously, before the state housing market blew up during the COVID-19 pandemic, the median value was $228,000 — meaning values have increased 66 percent.

The department’s valuations, produced every other year for the purpose of calculating property tax bills, are a somewhat delayed look at Montana’s real estate market. The new figures represent the department’s effort to estimate market conditions as of Jan. 1, 2024.

However, because state law keeps sale prices for individual properties private, the tax valuation data is one of the most comprehensive measures available for the Montana housing market at a time when housing affordability — and property tax bills — are major points of public concern.

The valuations indicate that the potential market price for the median residential property statewide increased by 35 percent during the 2023 reappraisal cycle, which accounted for shifts between 2020 and 2022, and then by another 22 percent with this year’s cycle.

The increases tabulated by the department generally align with data from other sources. A Montana housing price index kept by real estate website Zillow, for example, estimates that the price of the typical Montana home rose by 61 percent between the start of 2020 and the start of 2024. Zillow’s typical home value estimates are higher than the state figures — $449,000 at the beginning of 2024 and $465,000 as of June.

Buying a median $228,000 home in 2020 with a 10 percent down payment and a mortgage at the then-average 3.5 percent interest rate would have required a housing payment of about $921 a month, excluding property taxes and insurance. Four years later, with that median home at $378,000 and interest rates at 6.6 percent, the monthly housing payment would be about $2,173 — 2.4 times as much.

In comparison, the per-capita personal income available to the average Montanan grew by 26 percent over the past four years, according to the U.S. Bureau of Economic Analysis.

The average personal income as of 2024, $67,625, is enough for a $1,700-a-month housing payment if no more than 30 percent of income is put toward housing expenses.

Montana elected officials have responded to concerns about rising home prices by passing a number of laws in- tended to encourage housing construction, in some cases by limiting the power of cities and counties to restrict new development over concerns such as parking availability.

On the property tax side, lawmakers also passed a major tax code rework this year that aims to address how higher values have translated to higher taxes for homeowners and long-term rental landlords, ultimately shifting much higher taxes to residential properties being used as second homes.

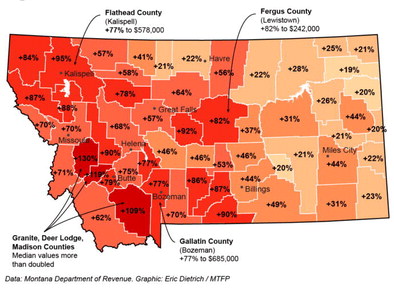

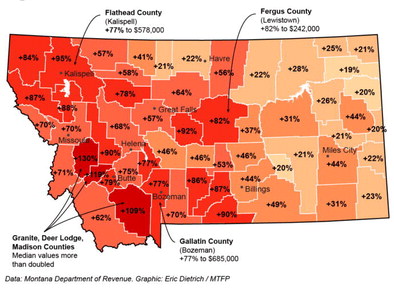

The most expensive home prices are generally in and around Montana’s fast-growing urban centers. Gallatin County, around Bozeman, has the state’s most expensive median home value, at $685,000, according to the state data. That’s a 77 percent increase in four years.

Madison County (including both Ennis and portions of Big Sky) has the second- highest median value at $671,000, followed by Flathead County (Kalispell) at $578,000 and Missoula County at $507,000.

Southwest Montana counties that have historically had affordable housing markets saw the fastest value growth. The median values in three southwest Montana counties — Granite (Philipsburg), Deer Lodge (Anaconda) and Madison — have more than doubled in four years.

Flathead County also came close to the doubling threshold, with a 95 percent increase in prices bringing the county median to $578,000.

Additionally, many rural plains counties in north-central and eastern Montana have also seen hefty increases in excess of 30 percent or 40 percent, according to the state data.

Fergus County, around Lewistown, for example, has seen its median home value increase by 82 percent in four years, to $242,000. Custer County, around Miles City, has seen a 44 percent increase, to $194,000.

During the first of the two COVID-era reappraisal cycles, growth was especially focused on western Montana. Some eastern Montana counties, such as Daniels (Scobey), Sheridan (Plentywood) and Roosevelt (Wolf Point) in the state’s northeast corner, actually posted modest value declines.

By the time numbers were tabulated for this year’s cycle, however, higher prices had come to eastern Montana. Daniels County, for example, shifted from an 8 percent decline to a 36 percent increase.

Additionally, 30 percent- plus growth sustained across both cycles in much of western Montana, particularly counties in the state’s northwest corner. Lincoln County, around Libby, for example, saw a 41 percent increase followed by a 31 percent one, bringing its median value up from $177,000 to $324,000.