Research Highlights Benefits Of Financial Literacy Education

Ongoing research at Montana State University is seeking to help educators across the country make decisions about high school financial literacy curricula. The research, led by professor Carly Urban of the Department of Agricultural Economics and Economics in MSU’s College of Agriculture, highlights how financial literacy education can positively impact students’ lives well beyond high school.

Urban, who has been at MSU since 2012, said that there had long been confusion among economists over which states required financial literacy education to be incorporated into high school curriculum. That confusion made it difficult for economists to make recommendations about financial literacy and get a full picture of the impact of those courses. In some areas, financial literacy was incorporated into a separate class, such as social studies or economics; elsewhere it was a stand-alone elective. Many states had no requirements at all surrounding the subject.

A large early step in Urban’s research career involved working to provide some clarity around the state of financial literacy.

“I was surprised that something this basic was something we didn’t know,” Urban said. “Not only what policies there are, but what existing policies are doing. We looked at graduation requirements and historical documents, and ultimately figured out that there were really no policies in the years we studied.”

However, Urban said, many states are now beginning to require financial literacy education in high school. Urban said this shift is paying off for teens when it comes to their credit and debt behaviors.

“That’s where we see the biggest effect of financial literacy education. Credit scores get better, because people are less likely to be behind on an account. People are less likely to engage in alternative financial services, such as payday lending, which can really lead to poverty cycles,” Urban said. “We also see a big effect on initial student loan borrowing decisions. They’re less likely to use credit cards while they’re in school, and they’re more likely to get grants and scholarships – those up-front types of funding – rather than subsidized loans.”

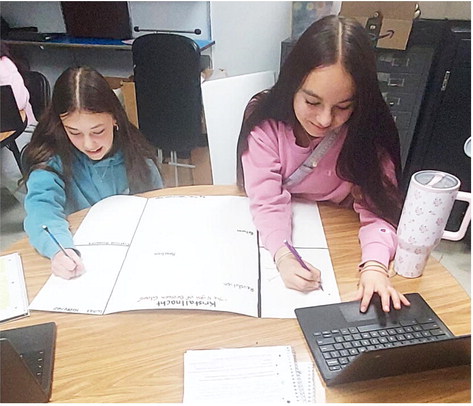

Montana is one of the states currently incorporating a financial literacy requirement into the high school curriculum. Beginning with the graduating class of 2026, all high school students in Montana will be required to complete a half-credit of financial education.

Urban noted that the benefits of such courses are well documented, but she acknowledged that adding new curriculum can be challenging in rural areas, where resources are often limited. Fortunately, Urban said, many nonprofit or public organizations are helping by creating free, high-quality content designed to help teachers incorporate financial literacy lessons.

Urban said that high school is the ideal time for financial literacy education because it’s the last time such a large group of young people around the same age will be together before they set out into careers, higher education and adulthood.

For the last four years, Urban has led a team of undergraduate and graduate student researchers from MSU and other institutions. They have collected data from every high school in the nation that publishes an online course catalog — about 10,000 schools. While the work can be slow, she said it lays a crucial foundation for providing policymakers and educators with accurate information about their state and region as they consider curriculum offerings and requirements.

“Every time a state contacts me wondering whether they need a policy on this, I can look at the data and tell them what’s really happening in their state. It’s really fun to be able to respond with accurate data to help people make decisions,” Urban said.

Providing that knowledge and service to the state she has called home for more than a decade is particularly gratifying, she said. While generating new research is exciting, ensuring that it can be properly understood and applied gives it an added level of purpose.

“Being in Montana is really cool for this kind of research because it’s such a small state by population,” she said. “You end up getting to know people really well, and there’s the capacity for real impact in a place like this.

“I think that having the right information in the right hands is the most important thing we can do as academics,” she added. “We know a lot of nuanced things, and getting that to the right people is super valuable.”