Unemployment Insurance Reforms Result In Savings

Joining the Montana Department of Labor & Industry (DLI), Gov. Greg Gianforte has announced more than 32,000 Montana businesses will see a reduction in 2026 unemployment insurance (UI) tax rates following the implementation of recent reforms, resulting in a savings of more than $23 million.

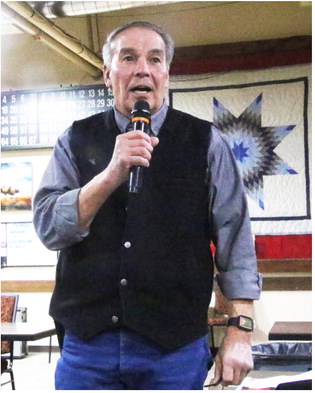

“By reforming our tax code and cutting back the thicket of red tape tying up job creators, we’re helping Montana businesses grow and attracting investment to the Treasure State,” Gianforte said. “Montana remains one of the best places in the country to start and own a small business. We’ll continue to make meaningful improvements to support business owners and the good-paying jobs they create.”

In July 2024, DLI Commissioner Sarah Swanson ordered a complete review of the UI trust fund, to ensure that the tax rates are fair to employers and that the trust fund is actuarially sound during economic downturns. The analysis revealed that the UI system in Montana is well-designed and that the trust fund was healthy enough to support a reduction in tax rates. To codify the new tax rates, during the 2025 legislative session the Montana legislature passed, and the governor signed into law, House Bill 210, sponsored by Rep. Steve Fitzpatrick, R-Great Falls, to create an automatic trigger to reduce rates when the trust fund balance exceeds 2.8 percent of total wages for the previous fiscal year.

“HB 210 made the UI system more efficient and predictable for the employers who fund it — producing significant tax savings — without reducing the UI benefits that Montana workers rely on,” said Swanson. “We will continue modernizing UI so it supports workers when they need it and keeps employer costs fair and reasonable.”

In 2026, 32,873 employers will see a UI tax rate reduction of 0.20 percent for all experience-rated employers. Additionally, more than 7,100 employers will receive a zero percent tax rate. Individual employers will begin receiving their 2026 tax rate classification letters next week.

Montana’s UI system is consistently rated among the top programs in the United States due to Montana’s practice of basing UI taxes and benefit amounts on actual average wages in Montana, rather than using a fixed statutory amount. That flexibility allows the trust fund to avoid overcollection while also preserving solvency.

To improve Montana’s business climate, the governor has also reformed the business equipment tax to ease the burden on small business owners, made Montana’s capital gains tax rates the fourth lowest in the nation, invested to boost trades education and build a stronger workforce, advanced reforms to increase Montanans’ access to more affordable housing, cut unnecessary, burdensome regulations, and made historic investments in infrastructure.